As an investor, understanding market cycles is critical to making sound investment decisions. One type of market cycle is a bear market. In this article, we will define a bear market, discuss its main characteristics, compare it to a bull market, and give you the best tips for investing in a bear market.

What is a bear market?

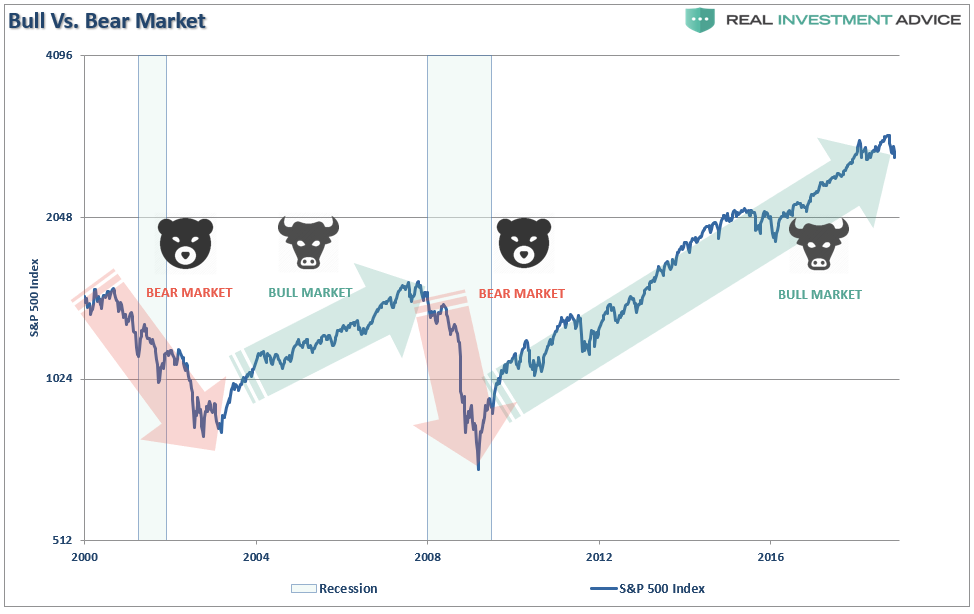

A bear market is a market cycle characterized by a steady decline in stock prices. This is usually associated with negative economic trends and widespread pessimism among investors. In a bear market, many stocks can drop in price and the market can experience long periods of volatility and uncertainty. This does not mean that stocks should fall significantly. The fall can be expressed in units of percent, but it will be stable and long-term with occasional slight growth. As an example, consider the decline in construction stocks in 2008. It will immediately become clear to you what a bear market should look like 🙂

Key Features of a Bear Market

In order for you to understand more about what a bear market is, we decided to give you a few basic characteristics of such a market. We give you signs based on our experience. Perhaps someone will disagree with our arguments.

Decrease in share prices. One of the main characteristics of a bear market is a steady decline in stock prices. Share prices of most companies tend to decline, causing investors to lose money. Of course, the fall can be -5%, or maybe -20%. You should pay attention not to the degree of falling stocks, and not the dynamics of the constant decline in prices. A good period for analysis is 2008. Most likely, 2023 will also be a great example in the financial sector or IT.

Pessimistic investor sentiment. A bear market is often associated with pessimistic investor sentiment. Investors are worried about the future of the market and tend to sell their investments, which leads to a further decline in stock prices. You can track such sentiments in the media, on forums. But it’s best to just follow a few investors in your sector and pay attention to the dynamics of their portfolio sell-off (for this, you must have some trading history of the investor being tracked).

Increased volatility. In a bear market, the stock market is usually more volatile. There may be larger price fluctuations, making it difficult to predict which investments will be successful. If you see price jumps in the aisles of 10-20%, this is a clear sign, because such peaks in a short period of time are not natural. We recommend taking this metric as the primary one for analysis.

Negative economic trends. A bear market is usually associated with negative economic trends such as high unemployment, low consumer confidence, and sluggish economic growth.

What is the difference between bear and bull markets?

A bear market is the opposite of a bull market. A bull market is a market cycle characterized by rising stock prices and investor optimism. The main difference between a bear market and a bull market is the mood of the investors. In a bull market, investors are bullish and stock prices rise, while in a bear market, investors are pessimistic and stock prices decline. Think of it as the simple opposite.

Top tips for investing in a bear market

Investing in a bear market requires a different approach than investing in a bull market. Here are some basic tips for investing in a bear market:

- Diversify your portfolio: This is to distribute your risk across different asset classes and investment vehicles. Otherwise, you can significantly lose in the value of your portfolio. Our team understands diversification not only as “different” companies, but also as different sectors of the economy. We do not lay all our eggs only in the IT sector or the financial sector.

- Focus on high-quality investments: In a bear market, it is important to focus on high-quality investments that can withstand market volatility. Your task is to find companies with real profits and real advantages that will allow the company to develop in their sector in the next year (and ideally 5-10 years). This is exactly what we did in 2022, when the financial sector began to coward the US market and the first financial institutions closed.

- Stay investing for the long term: It’s important to remember that bear markets are temporary and stock prices will eventually bounce back. By staying investing for the long term, you can survive the ups and downs of the market.

- Don’t try to time the market: Trying to time the market can be challenging and you are unlikely to succeed. Instead, focus on your long-term investment strategy and avoid making impulsive decisions based on short-term market trends.

Conclusion

A bear market is a market cycle characterized by a steady decline in stock prices and negative investor sentiment. In our article, we tried to explain in the simplest terms the essence of the term and what steps to take if the market enters this phase. Our main advice is to diversify your portfolio and avoid sudden moves if things don’t go according to plan. Watch out for other investors. Our experience shows that any investor has ups and downs. The main thing is not to despair.